Costa Rica Real Estate Guide by RE/MAX Pura Vida in Santa Teresa

Our top real estate agents and full-service offices created this Costa Rica Real Estate Guide to answer some of our most frequently asked questions. If your questions are not answered below, contact us, and we will be happy to have one of our specialists assist you.

Foreign Investment: Why are so many expats choosing Costa Rica?

Why are so many expats choosing Costa Rica for investment?

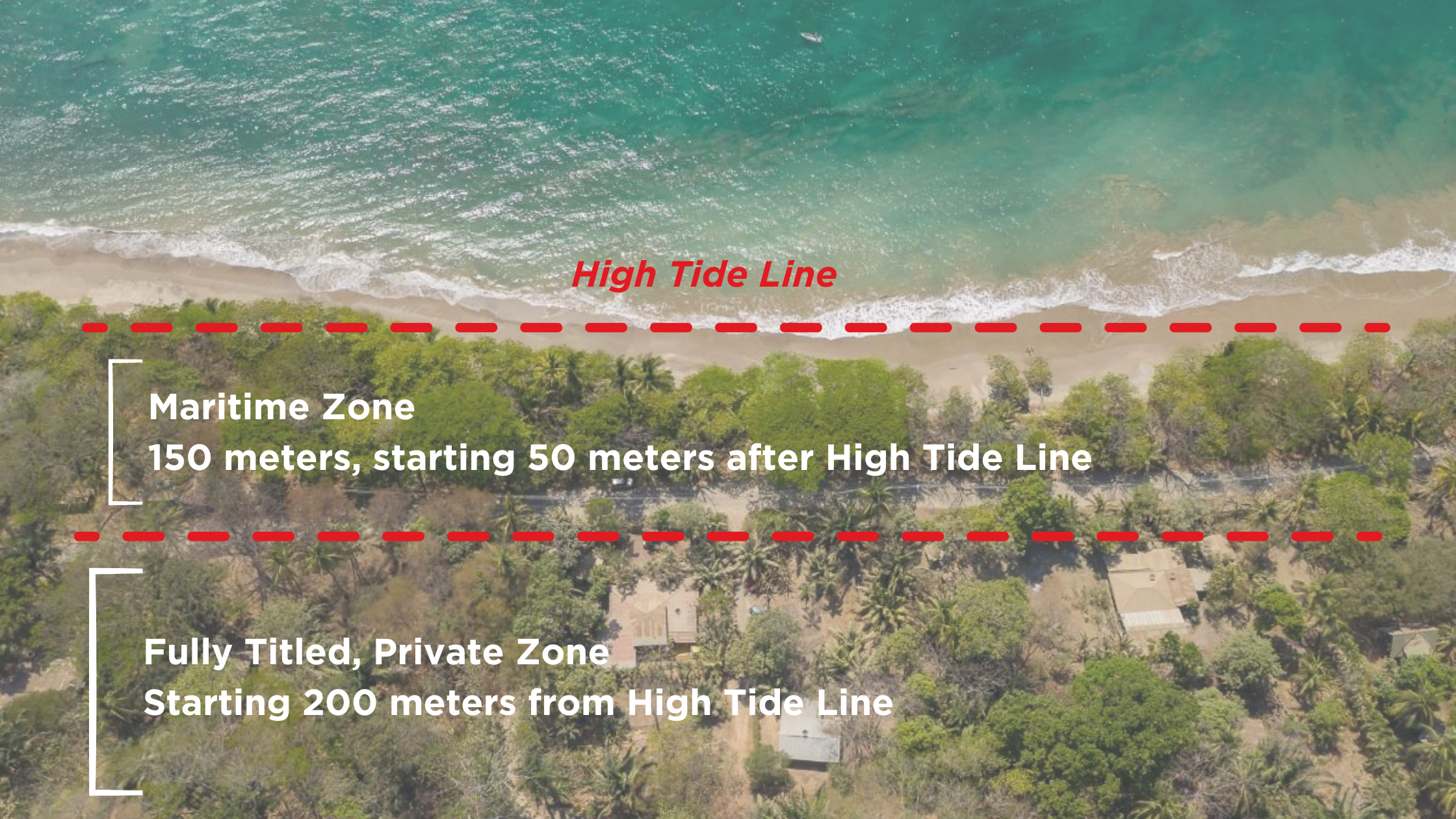

Costa Rica allows foreigners to buy property like locals, unlike most Latin American countries. This applies to most property sold, but the Maritime Zone is an important exception. The zone covers the first 200 meters off the Pacific and Atlantic coasts. In the 1970s, a law granted beachfront property owners a fee-simple title. Only 10-15% of landowners utilized this, leaving 85-90% of the coast under government concession in a restricted lease. Ownership and development restrictions on concession property prioritize environmental protection but also present obstacles for foreign ownership. When purchasing beachfront condos, homes, or lots in Santa Teresa, prioritize fully titled properties.

Safe Investment | Real Estate Due Diligence

Is investing in Costa Rica safe? What about real estate due diligence?

The political and economic climate in Costa Rica is stable. A National Property Registry makes due diligence transparent and clear for all properties. Purchasing under a Costa Rican legal entity reduces personal liability, simplifies transfer upon death, and offers a straightforward structure for shared ownership.

Costa Rica’s Low Cost of Living

What is the cost of living like in Costa Rica?

The cost of living and quality of life are major factors influencing foreign buyers in the Costa Rican real estate market. The low annual holding costs of real estate are a plus, with very low property taxes—0.25% of the declared value ($250 per $100,000) per year. High-quality healthcare and dentistry are 50-70% cheaper than in other countries. Phone, cable, and high-speed internet are available in most developed areas. In contrast to other international destinations, the water throughout Costa Rica is drinkable. Costa Rica offers affordable living without compromising quality of life.

Life Quality: Climate and Landscape

What is the climate and landscape like in Costa Rica?

Costa Rica has something for everyone! Within a relatively short distance, you can discover diverse climates and landscapes, including cooler mountains, beaches, dry regions, and rainforests. The coast features year-round tropical beaches with temperatures ranging from the high 70s to the mid-90s. The central valley and mountain highlands offer year-round spring weather with mid-60s to mid-80s breezes.

Property Market Values and Influencers

What influences property market values in Costa Rica?

The overall economic health of Costa Rica influences property values. A stable or growing economy can lead to increased demand and higher property values. Both domestic and foreign demand impact the market. The country is popular among expatriates, retirees, and investors, driving up prices in certain areas. Location is key for resale value. Properties in or near popular tourist destinations, beaches, and national parks tend to have higher values. Easy access to roads, airports, and other transportation facilities can increase property value. Availability of essential services like electricity, water, internet, and cell service is also important. Proximity to amenities such as beaches, golf courses, shopping centers, restaurants, and hospitals can affect property values.

Buying and Owning Costa Rican Property

Can foreigners buy and own property in Costa Rica?

Yes, foreigners and foreign entities can buy property without restrictions. You can buy “Fee Simple,” fully titled property with the same ownership rights as in North America. Any beachfront property registered before the 1977 Maritime Zone Law currently has its own title. Otherwise, it is a concession of ownership. Furthermore, if you buy a condo, you’ll be subject to the community’s bylaws, which may include pet restrictions, voting rights, monthly homeowners fees, front yard or terrace restrictions, etc.

Concession Property / Maritime Zone

What should I know about concession property in the Maritime Zone?

The first 50 meters from the mean high tide mark are government property, so no one can build or encumber it. The next 150 meters in 95% of Costa Rica is the Maritime Zone, which can be developed with municipal “concessions.” This means that the property is leased land from the government, so it is not fee-simple. The concession term is usually 20 years, with an annual fee.

Proper Property Registration and Transfer Deeds

How does property registration and transfer work in Costa Rica?

Proper property registration and transfer deeds are crucial when buying Costa Rican real estate. The National Registry holds public records of all Costa Rican property, including its location, measurement, boundaries, survey map, liens, and mortgages. To transfer registered property, the owner must appear before a Notary Public and grant a public conveyance deed that is presented and recorded with the National Registry. The National Registry protects registered property rights.

Buying Property with Corporations

Why should I consider buying property through a corporation in Costa Rica?

Foreigners can buy titled property in their own name, but a Costa Rican corporation has advantages. The main benefit is that corporation ownership limits personal liability for property. A power of attorney can then be granted to buy or sell property. Foreigners can also obtain utilities through a Costa Rican corporation if they cannot do so themselves. The annual tax for corporations depends on whether they are “active” or “inactive.” An active corporation has income-generating activities like vacation rentals and pays $190 in taxes. Inactive companies pay $115. Both Sociedad Anonima (S.A.) and Sociedad Responsabilidad Limitada (S.R.L.) corporations are common in Costa Rica. An attorney can help you choose the best structure for your goals and situation.

Costa Rica Real Estate Purchase Process

What should I expect when buying Costa Rican property?

If you have a good real estate agent, a reputable attorney, a safe third-party escrow account, qualified home inspectors, and the like, buying in Costa Rica is simple. Nevertheless, Costa Rica has no Multiple Listing Service (MLS) or real estate licensing requirements, so it’s important to work with a qualified and experienced agent who knows the market. RE/MAX offers this extra level of accountability and training to assure that each deal is handled with care and diligence.

Closing Costs

What are the typical closing costs in Costa Rica?

Closing costs are usually split 50/50 between the buyer and seller or paid for by the buyer, but any variation is possible. Two scenarios exist for buying or selling property:

- Share Transfer Agreement: The corporation that owns the property buys it from the seller. The corporation owns the property and will add the buyer to the board of directors at closing. New shares of stock will reflect the buyer’s property interest. Typical Share Transfer Agreement Closing Costs:

- Legal Fees: 1.25% + VAT

- Transfer Tax: 1.5%

- Escrow: $550 + VAT for transactions under $500,000 + $200 to record

- Property Transfer: The Costa Rican National Registry registers the new owner after the property is sold. A property transfer occurs when a corporation sells a property to another corporation or the buyer. Typical property transfer closing costs:

- Legal Fees: 1.25% + VAT

- Transfer Tax: 1.5%

- Escrow: $550 + VAT for transactions under $500,000 + Recording costs approximately 0.85%, depending on transfer value and property type.

Costa Rican Taxes

What taxes should I be aware of when owning property in Costa Rica?

- Property Tax: 0.25% of the registered value per year, or $250 for a $100,000 property. Property taxes are due quarterly, but you can pay until the end of the year and save 5%. Most urban districts charge for garbage collection and maintenance.

- Luxury Tax: Homes and condos over $230,000 incur a 2.5% to 5.5% luxury tax. The total property taxes on a luxury home would be 0.25% property tax + 0.25% luxury tax = 0.5%.

- Capital Gains Tax: Since July 1, 2019, capital gains have been taxed at 15% on value gains from purchase to sale for investment properties. Primary residences are exempt.

- Income Tax: Only Costa Rican residents and corporations pay taxes on income earned there. Vacation rental property owners must file annual tax returns and pay taxes on their net income.

Rental Management | Income | ROI

How does rental management work in Costa Rica?

Many buyers do not live full-time in Costa Rica and need a property manager. These managers perform preventative maintenance, respond to issues, and generally offer accounting services, paying owners’ utilities, property taxes, HOA fees, etc. Most top-producing managers in our area charge 35% commission on short-term rentals and 20% on monthly rentals. Managers usually promote properties on popular websites, personal websites, social media, and local and international advertising. Some owners can generate their own rentals, so most managers charge a “key fee” or “check-in fee” instead of a percentage of the rent. For $30 to $125 per reservation, depending on the length of stay and property quality, the manager will check guests in and out and usually offer concierge services.

Buyer or Seller of Property in Costa Rica?

Why choose a RE/MAX agent for buying or selling property?

Whether you’re buying your dream home or selling a cherished property, it’s a venture filled with potential and promise. Choosing a RE/MAX agent for this pivotal journey isn’t just a decision—it’s a partnership with seasoned professionals who bring a world of experience, local expertise, and unwavering dedication to your doorstep. RE/MAX agents in Costa Rica

are unparalleled experts in navigating the unique market dynamics, ensuring every step of your transaction is seamless, efficient, and rewarding. From leveraging cutting-edge marketing strategies to showcasing properties to the right buyers to tapping into a global network that spans over 110 countries, our agents go beyond traditional real estate practices. We are committed to understanding your needs, negotiating the best terms, and guiding you through each phase with transparency and integrity. With a RE/MAX agent by your side, you’re not just entering the real estate market—you’re stepping into a future built on trust, innovation, and exceptional results. Choose RE/MAX Pura Vida to make your real estate journey in Costa Rica an experience of unmatched excellence.